WASHINGTON — Wholesale prices for Grade A large eggs (for the retail market) have plunged nearly 30% since the first of the year, quoted at six-month lows as of Jan. 25. Grade A medium egg prices quoted by the U.S. Department of Agriculture have tumbled nearly 40% during the same time and were down more than 50% since late November. Medium eggs tend to be shifted to processors when they aren’t selling well at retail, or if supply exceeds retail demand, competing with nest run eggs (breaking stock) and adding to supplies breakers turn into egg products.

WASHINGTON — Wholesale prices for Grade A large eggs (for the retail market) have plunged nearly 30% since the first of the year, quoted at six-month lows as of Jan. 25. Grade A medium egg prices quoted by the U.S. Department of Agriculture have tumbled nearly 40% during the same time and were down more than 50% since late November. Medium eggs tend to be shifted to processors when they aren’t selling well at retail, or if supply exceeds retail demand, competing with nest run eggs (breaking stock) and adding to supplies breakers turn into egg products.

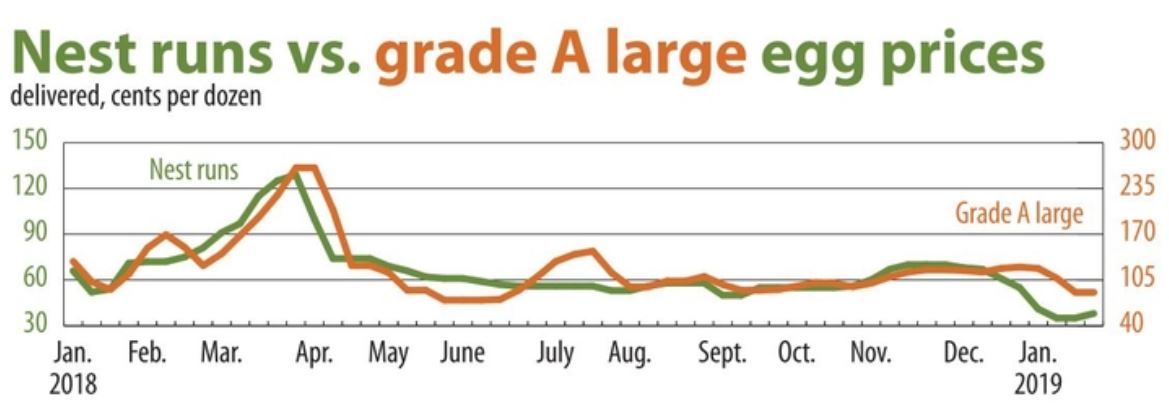

Prices for nest run eggs were down about 30% as of Jan. 25 and were down 45% from late November, reflecting pressure from weakness in graded medium eggs.

Most egg product prices were stable for an extended period last year, before finally following egg prices lower beginning in December.

Yolk prices were the most stable for the longest period, moving only a couple cents per pound from February into September for dried and from February into December for frozen and liquid yolk.

The question now is, where are prices headed? Does recovery lie ahead as egg product demand remains strong? Will prices fall further due to excess egg supply? Or is something bigger on the horizon?

Historically, egg prices peak in the spring when Easter demand strains retail supplies, decline during the summer and then move higher again later in the year due to the fall and holiday baking seasons.

But those trends have not been set in stone for several years due to a number of mostly unique but dramatic events. Egg white prices soared to record highs several years ago when egg-white-only breakfast entrees became popular. Egg and most egg product prices then surged to record highs when markets were highly disrupted by the massive avian influenza outbreak in 2015. Then, early last year discovery of fipronil, an unapproved chemical, in some key European markets resulted in an increase in export demand and sharply higher prices. Peak Grade A large egg prices in March 2018 were only a few cents shy of the influenza-induced 2015 record, but breaking stock egg prices failed to keep pace, remaining more than $1 a dozen below the 2015 record high.

But those trends have not been set in stone for several years due to a number of mostly unique but dramatic events. Egg white prices soared to record highs several years ago when egg-white-only breakfast entrees became popular. Egg and most egg product prices then surged to record highs when markets were highly disrupted by the massive avian influenza outbreak in 2015. Then, early last year discovery of fipronil, an unapproved chemical, in some key European markets resulted in an increase in export demand and sharply higher prices. Peak Grade A large egg prices in March 2018 were only a few cents shy of the influenza-induced 2015 record, but breaking stock egg prices failed to keep pace, remaining more than $1 a dozen below the 2015 record high.

But 2019 may still prove to be a pivotal year for eggs, one industry source said. An ongoing structural change in the industry has played a key factor in the ample supply of eggs. That change involved the rapid increase in cage-free egg production the past couple of years that surpassed cage-free egg demand and occurred without a like reduction in conventional egg production, resulting in millions of excess laying hens and eggs and, at times, historically low egg prices. One industry source estimated that about 2% to 3% of total egg supply is excess cage-free eggs being sold at a loss as conventional eggs.

The increase in cage-free egg production was spurred by significant egg user “commitments” to switch to cage-free eggs by 2020 or 2025 as producers got ahead of the demand curve. But many of those buyers have yet to make the switch, or to inform producers that they will buy only cage-free eggs in 2020.

“It’s already too late,” the source said.

He noted that the potential demand for cage-free eggs far exceeds the percentage of cage-free eggs currently being produced that exceeds demand. Egg producers are no longer willing to build cage-free housing and wait for demand to come to them, he said. Instead, they will insist that buyers sign supply agreements guaranteeing a home for the cage-free production. Many of those potential cage-free buyers will have to back out on their 2020 commitment, or “kick the can down the road” and make the switch in a couple of years when more cage-free housing is built, the source said.