WASHINGTON — Younger generations are more likely to seek food information on social media sites, but all consumers often find the information conflicting on formats such as Facebook, YouTube and Instagram, according to The International Food Information Council’s 2023 Food and Health Survey.

The survey of 1,022 Americans of the ages 18 to 80 took place April 3-10. IFIC released the findings May 23. This year’s annual survey was the first time IFIC included social media data.

The survey of 1,022 Americans of the ages 18 to 80 took place April 3-10. IFIC released the findings May 23.

While 41% said they have seen social media content on food and nutrition in the past year, the percentages were higher among Gen Z at 71% and millennials at 58% than among Gen X at 36% and baby boomers at 22%. The top social media platforms were Facebook, YouTube and Instagram. While 60% of those who came across social media content on food and nutrition said it encouraged healthier choices, 68% said they had seen conflicting information about what foods to eat or avoid.

“Social media has morphed from a mere networking platform into a digital dining table, shaping our food choices, stirring culinary curiosity, and serving as a recipe for both clarity and confusion in our nutritional narratives,” said Wendy Reinhardt Kapsak, president and chief executive officer of IFIC. “Social media discourse about food is not just a fad. It has grown into a de facto nutritionist for millions of Americans, influencing consumer attitudes and decisions, but with information that can vary in both its accuracy and impact.”

Americans apparently are noticing higher prices. The percentage of respondents saying price highly impacted their decisions to buy food and beverages rose to 76% from 68% last year. Women at 82% were more likely than men at 70% to say price significantly impacted their decisions. Ninety-one percent said they noticed an increase in the overall cost of foods and beverages, up from 83% last year, and 47% said they always or often bought new products and brands that were less expensive.

Over a third (34%) of respondents said environmental sustainability highly impacted their decisions to buy food and beverages. When asked whether a product’s climate friendliness impacted their purchasing decisions, 35% said yes. Among the 35%, the top categories where they said it made a difference were meat and poultry at 62%, fresh fruit and vegetables at 55%, and dairy at 50%.

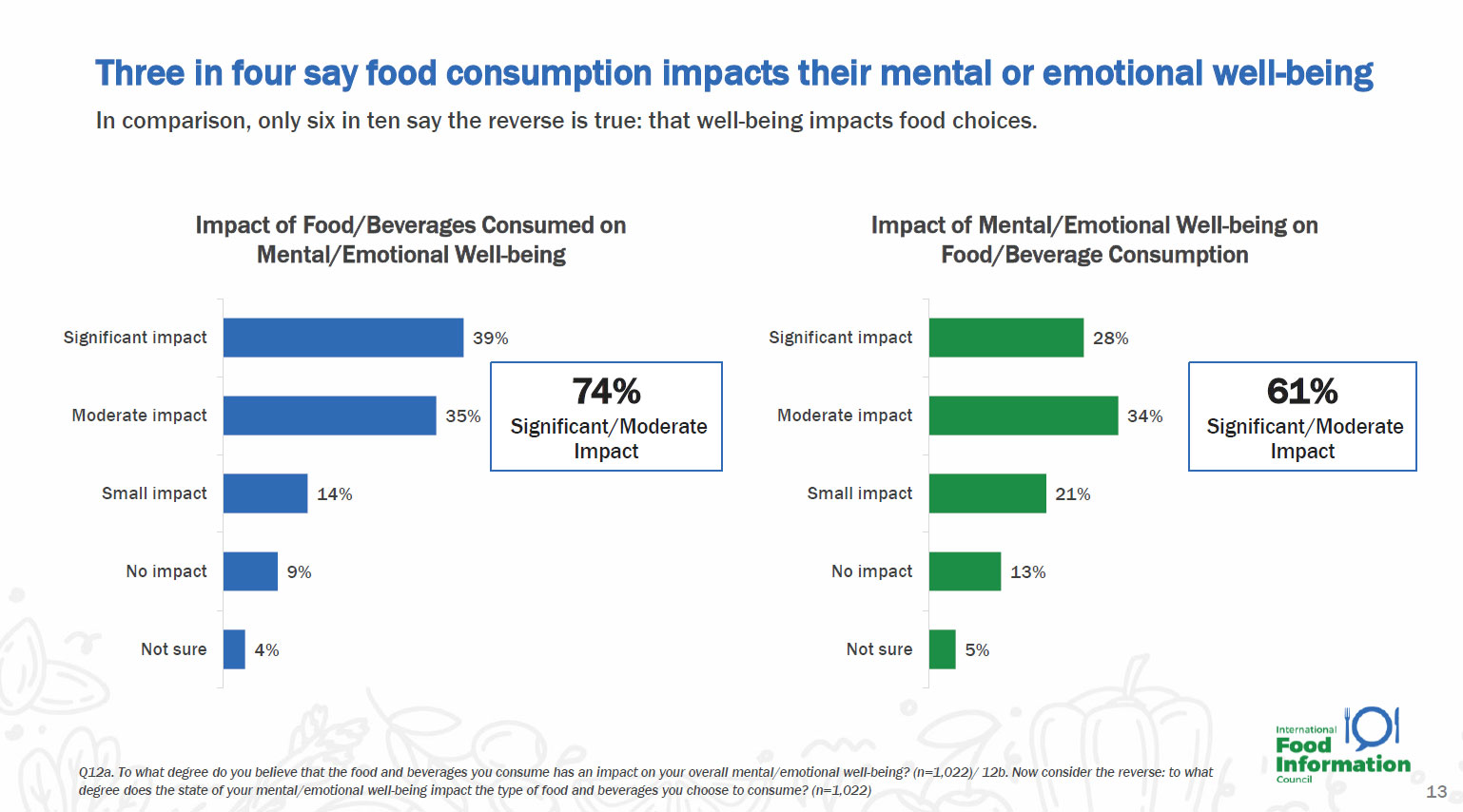

When asked whether they believe the food and beverages they consume have a significant or moderate impact on their overall mental and emotional well-being, 61% said yes with Gen Z leading the way at 71% and followed by millennials at 68%.

Other categories covered in the survey included diets, snacks and nutrients.

Like last year, 52% said they had followed a specific eating pattern in the past year with Gen Z at 66% and millennials at 63% more likely to do so. A high-protein diet at 18% was the most popular, followed by mindful eating at 17%, calorie-counting at 12%, clean eating at 12% and intermittent fasting at 12%. The percentages fell for ketogenic or high-fat diet, to 4% from 7% last year, and for gluten-free diets, to 6% from 9%.

The percentage of respondents who said they snack at least once a day slipped to 72% from 73% last year. Top snacks consumed in the morning included fruit at 30%, dairy at 14%, Danishes, donuts and pastry at 14%, and nutrition bars at 13%. Salty and savory snacks were the most popular in the afternoon at 31% and in the evening at 26%.

Protein, at 67%, fiber, at 61%, and vitamin D, also at 61%, were the top choices when respondents were asked what nutrients they were trying to consume. When asked about protein sources, 28% said they were trying to consume much more or somewhat more protein from whole-plant sources, followed by poultry at 26%, seafood at 23%, eggs at 22% and plant-based dairy alternatives at 22%. Dairy fell to 19% from 25% last year, and blended meat products fell to 14% from 20%.

Seventy-two percent said they were trying to limit or avoid sugars. Among the 72%, 59% said they were trying to limit or avoid added sugars, followed by all types of sugars 27% and sugars naturally present in foods at 14%.

“The 2023 IFIC Food and Health Survey is a comprehensive snapshot of the complex factors that shape American food and nutrition choices,” Ms. Reinhardt Kapsak said. “As we navigate the shifting landscape of food production and consumption, this survey underscores the importance of balancing competing priorities and consumers’ desire for clear and accurate information that empowers them to make the best food and beverage decisions for themselves and their families.”